Excessive debt? Take this quiz to find the best solution for you.

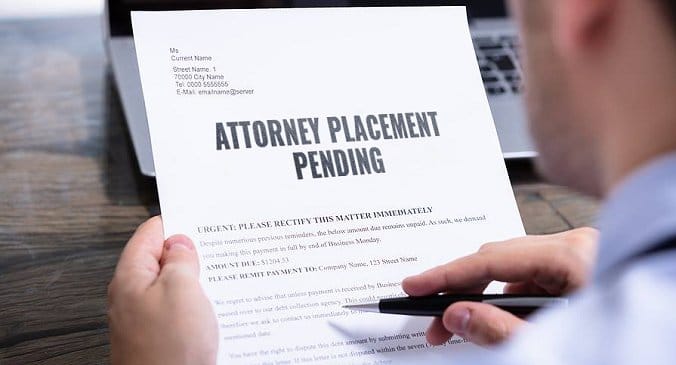

If you receive a collection letter from American Express or Discover Card saying, "Attorney Placement Pending" ...

Are they bluffing about sending your account to an attorney ... or should you take this seriously?

In our experience, they are not bluffing and they really do intend on sending your past due account to an attorney for possible litigation against you.

To understand what you're up against, here's a crash course on the debt collection process ...

The Debt Collection Complex

Debt collection is a very linear, regimented process:

FAQ: Debt Collection Law Firm

So what exactly happens when your account is transferred to a collection law firm?

The good news is there are mechanisms in place and well-defined steps that must be taken before creditors can begin seizing your assets. But if you're sued, you must respond in a timely manner, otherwise you will lose the lawsuit by default. (Hence, the term default judgment.)

Now the bad news.

Once a creditor receives a judgment against you, that judgment can remain valid for 3-20 years, collecting interest all the while. It's not going away. You'll need to check the statute of limitations for your state to see how long judgments remain valid.

PRO TIP: The deeper you get into the collection process, the less likely you are to reach a favorable agreement because you've forced the creditor, collection agency or collection law firm to commit time and resources attempting to collect the past due balance. Therefore, taking action to resolve a past due balance sooner rather than later usually results in the most favorable outcome for you.

* Donaldson Williams is not a law firm and we do not provide legal advice. If you seek legal advice, you must consult with a competent attorney in your state.